At His CPA PC…We Seek GROWING Business Owners & Entrepreneurs

/in Blog /by John DillardAt His CPA PC…We Seek GROWING Business Owners & Entrepreneurs The below is a letter we have sent a client confirming Success: Since we met in 2015 we have worked with you hand in hand to save you approximately $52,000. For when we first met you had an individual who was to be an owner […]

How His CPA Became a Christian CPA Firm; Experience the Difference

/in Blog /by John DillardI am His CPA. Though have won/earned honors since the mid 1970’s and forward the thing I am most blessed with is to be a Christian CPA. Explore how one Christian CPA can help you as you GROW your business!!! How His CPA Became a Christian CPA Firm

Should My New LLC Convert to an S Corporation for Tax Purposes?

/in Blog /by John DillardShould My New LLC Convert to an S Corporation for Tax Purposes? Generally speaking if your new entity does not need to be an LLC for tax purposes you should consider converting to an S Corporation for the tax savings. For as long as you satisfy the tax requirement of all corporations of paying the […]

Serving God by Serving You…One Tax Return at a Time = “Friends for Life”

/in Blog /by John DillardServing God by Serving You…One Tax Return at a Time = “Friends for Life” This has been a watchword for us since Day 1 when God called my www.HisCPA.com to be an EVEN brighter light for the Kingdom! Whether we are doing personal or corporate income tax returns, assisting clients with their bookkeeping or internal […]

Georgia Tax Law Changes for Georgia Business Taxpayers & Entrepreneurs

/in Blog /by John DillardGeorgia Tax Law Changes for Georgia Business Taxpayers & Entrepreneurs Georgia Governor Nathan Deal signed House Bill 918 reflecting changes in Georgia law to reflect IRS Tax law updates. Some of the more significant changes affecting Georgia Business Owners & Entrepreneurs are: Effective January 1, 2019 Georgia reduced the personal and corporate tax rates to […]

Just saved a client over $800,000

/in Blog /by John DillardJust saved a client over $800,000 We just got through working with a client with returns going back over 10 years with multiple sole proprietorships, real estate investments, an S Corporation and lots of unprepared and unfiled tax returns. At our initial meeting with the client we discussed our strategy of preparing the old unfiled […]

“The best time to hire www.HisCPA.com was 20 years ago. The second best time is now”

/in Blog /by John Dillard“The best time to hire www.HisCPA.com was 20 years ago. The second best time is now” -John Dillard CPA “The best time to plant a tree was 20 years ago. The second best time is now.” -Chinese Proverb

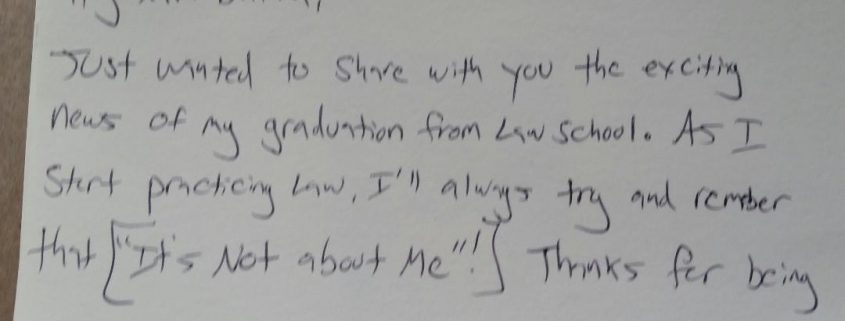

Life is Not About You; It’s About Those You Help

/in Blog /by John DillardLife is Not About You; It’s About Those You Help If You Win Everything and Keep It for Yourself, You Lose it ALL. If You Give Away ALL you Can You Get it Back… Ten Fold!!! Smile…You May be the Only Jesus Someone Sees Today

Tax Cuts and Jobs Tax Act of 2017 vs. Meals and Entertainment Expenses

/in Blog /by John DillardEffective January 1, 2018 the IRS has dramatically changed the way business owners record and deduct Meals and Entertainment: Entertainment expense is no longer deductible. Business meals remain 50% deductible. Items benefiting employees (not the owners) such as recreational/social activities (i.e., Christmas parties) are deductible at 100%. Accordingly I suggest setting up in your chart […]

The New Tax Act Has LOTS in Store for Many Including…

/in Blog /by John DillardThe New Tax Act Has LOTS in Store for Many Including… Tax bracket reductions for individuals, S Corporations, LLC’s & C Corporations I recommend all taxpayers do tax planning for 2018 as soon as they complete their 2017 tax returns. Some of the major changes for individual taxpayers include no more exemptions, increased standard deductions […]

Atlanta CPA Advises on Filing of Back Taxes & Old Income Tax Returns

/in Blog /by John DillardAtlanta CPA Advises on Filing of Back Taxes & Old Income Tax Returns The filing of old back tax returns often “freezes” taxpayers who become too scared to address their open monies. Below is an example of an inquiry from a taxpayer seeking advice on filing of past unfiled income tax returns: I’m looking for […]

Are You Receiving Threatening Letters from the IRS?

/in Blog /by John DillardIs the IRS Breathing Down Your Back? Are You Receiving Threatening Letters from the IRS? Has the IRS Sent You a Garnishment, a Tax Lien or Notice of Seizure? Do you have unpaid income taxes, payroll taxes or sales taxes? Are IRS Tax Problems Breaking Your Back? Got Old Back Taxes That Need to Be […]