Today is the Worst Day satan EVER Had; Happy Easter!

/in Blog /by John DillardToday is the Worst Day satan EVER Had; Happy Easter! What satan had hoped would be the best day in his world. Just 3 days later became the worst day satan ever had. Our Lord Jesus Christ is Risen. He has Risen Indeed!!!! p.s. Remember the correct way to eat a chocolate bunny is ears […]

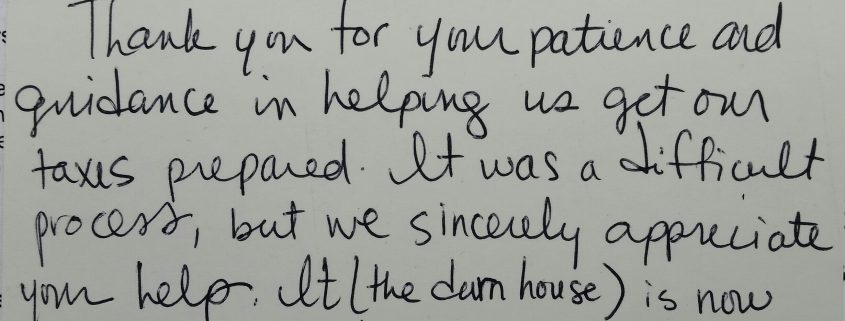

IRS Representation, Back Taxes, Offer in Compromise, IRS Fresh Start Initiative, Penalty Abatement, Tax Advocacy, Tax Audits, How to Avoid Tax Audits, Tax Notices & Solving IRS Tax Problems

/in Blog /by John DillardIRS Representation, Back Taxes, Offer in Compromise, IRS Fresh Start Initiative, Penalty Abatement, Tax Advocacy, Tax Audits, How to Avoid Tax Audits, Tax Notices & Solving IRS Tax Problems His CPA: A 30A Christian CPA Firm Serving the Emerald Coast. Serving Santa Rosa Beach, Seaside, Seagrove, Grayton Beach, Miramar, Blue Mountain, Destin, Sandestin, Panama City […]

HisCPA: A 30A Santa Rosa Beach Christian CPA Firm Proudly Serving the Emerald Coast including Santa Rosa Beach, Seaside, Seagrove, Grayton Beach, Miramar, Blue Mountain, Seacrest, Inlet Beach, Rosemary Beach, Alys Beach, Watersound, Destin & Sandestin, Panama City Beach, Fort Walton, Freeport, Niceville & Panama City as an Award Winning CPA.

/in Blog /by John DillardIs it Time for Your GROWING Business to Work with a Virtual CFO/CPA?

An award-winning CPA serving 30A and the Emerald Coast as a virtual CFO CPA

/in Blog /by John DillardAn award-winning CPA serving 30A and the Emerald Coast as a virtual CFO CPA. As a Christian CPA we seek to serve God by serving you one tax return the time that by giving you advice and wisdom and they’re both tax law and running your business. Give us a call you’ll be glad you […]

IRS announces 2019 mileage rate for business miles

/in Blog /by John DillardFor 2019 the IRS standard mileage rates for the use of a car (also vans, pickups or panel trucks) will is 58 cents per mile driven for business use (an increase of 3.5 cents from the rate for 2018). Be sure you keep a by day log to support all your business miles.

Do You Know Why You are Experiencing Payroll Withholding and Quarterly Tax Payments?

/in Blog /by John DillardDo You Know Why You are Experiencing Payroll Withholding and Quarterly Tax Payments? I do and you should to. During World War II, Congress introduced payroll withholding and quarterly tax payments to help fund the war. As you know World War II has been over now for some seven decades but the withholding and quarterly […]

Charleston Dawn by John Dillard CPA

/in Blog /by John DillardWhile you’re laying on the beach you want to check out a good Christian fiction romance murder mystery set in the ambience of Charleston South Carolina. John Dillard as author rocks. Charleston Dawn; romance the way God intended.

Tax Law Changes and Year-end Tax Planning

/in Blog /by John DillardWanted to remind you of the need to do 2018 year-end tax planning so we might avoid surprises as well as keep your tax bill as low as legally possible. Please forward your year-to-date data and a forecast for the rest of 2018 so we might update your tax planning accordingly. Keep in mind […]

The Time to Prepare for Your Year End Taxes is NOW!

/in Blog /by John DillardThe Time to Prepare for Your Year End Taxes is NOW! Don’t let the end of the year sneak up on you. Be sure to start getting your tax data and deductions together NOW so you will be well prepared to take every legal tax deduction available to you under Tax Cuts and Jobs Act […]

Due Diligence When Buying a Business

/in Blog /by John DillardPerforming Due Diligence When Buying a Business. The below is a sample letter that we might receive from a potential client looking to buy a new business and a draft of what my response might be. Hi, John. I’ve been presented an investment opportunity that I think I’m really interested in. There are a lot […]

We Offer a Free Review of Business/Corporate Income Tax Returns

/in Blog /by John DillardWe Offer a Free Review of Business/Corporate Income Tax Returns Whether you are a sole proprietorship, LLC, S Corporation, Partnership or a C Corporation We Offer a Free Review of Corporate/Business Income Tax Returns Just Earlier Today We Did a Review of a Prior Tax Return Saving a Taxpayer Thousands of Dollars.

2018 Deduction for Pass Through Entities for Small Business Owners

/in Blog /by John Dillard2018 Deduction for Pass Through Entities for Small Business Owners In President Trumps most recent tax law changes there is a 20% deduction for Pass Through Entities for Small Business Owners. Be sure in addition to the tax rate deductions available to all personal returns your CPA considers this in your 2018 tax planning. The […]

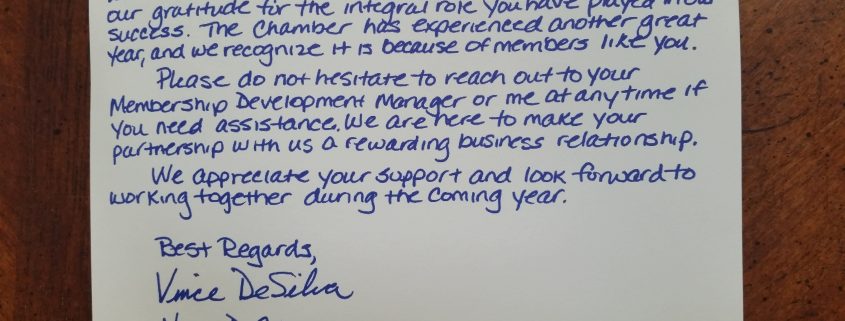

25 years and growing as a Gwinnett Chamber of Commerce member

/in Blog /by John DillardIt is now 25 years and still growing as a Gwinnett Chamber of Commerce member. The Gwinnett Chamber of Commerce is the greatest place I have ever found in the entire world to promote and grow your business and to work with other business owners and entrepreneurs in the area. Get connected. It’s your best […]

Excellence Matters!!!

/in Blog /by John DillardExcellence matters. Make sure you work with a CPA who exceeds not only their own HIGH standards but exceeds your expectations.

Is Your Business Set for GROWTH?

/in Blog /by John DillardUsing a Virtual CFO and do MUCH to Help Your Business Achieve Higher Sales Levels & Profitability. Is Your Business Set for GROWTH? Atlanta Virtual CFO/CPA for Your GROWING Business #VirtualCFO #VirtualCPA